how to determine tax bracket per paycheck

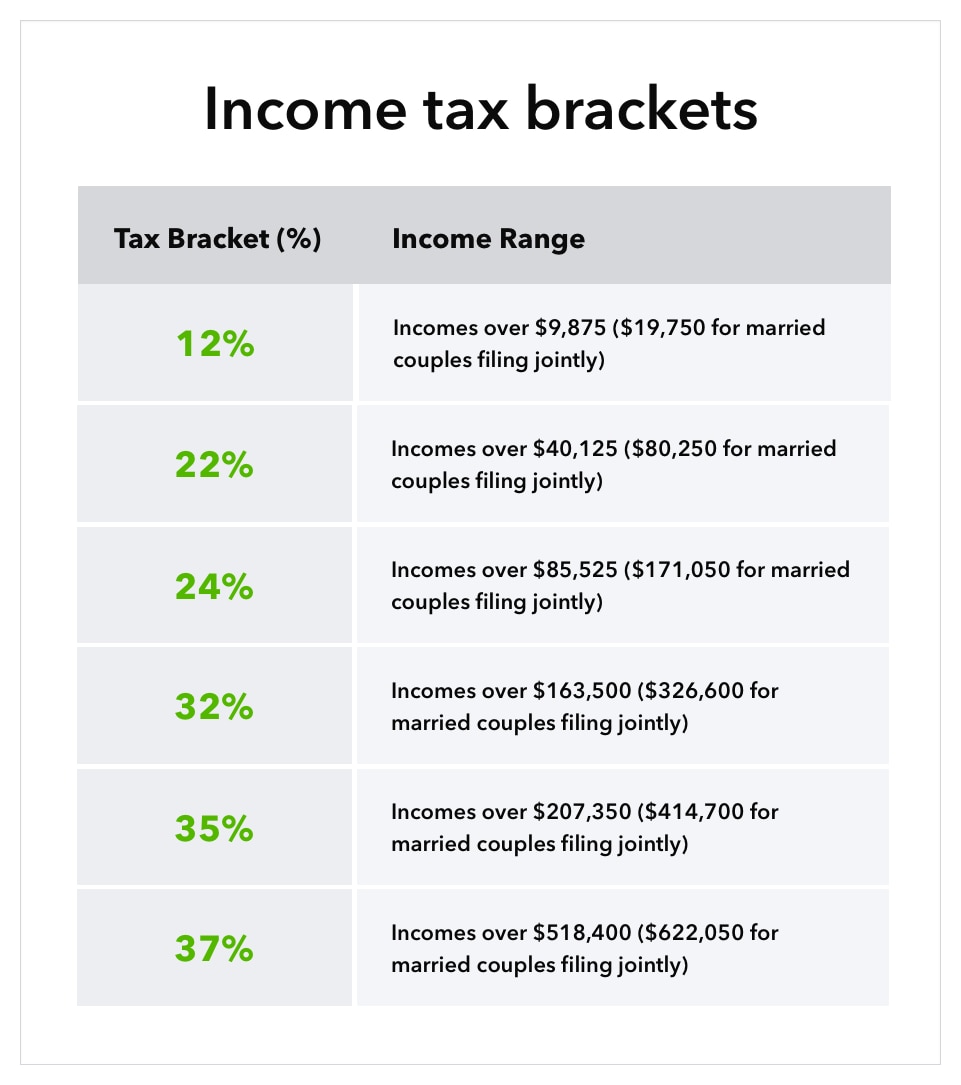

The next 30575 is taxed at 12. Use this tool to estimate.

Which 2020 Withholding Table Is Correct R Tax

The size if the bracket depends on.

. The tax brackets for 2018 are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. How To Determine Tax Bracket Per Paycheck. For example if you earned 100000 and claim 15000 in deductions then your taxable.

You always fill up lower brackets before moving on to the next higher bracket. Understand tax withholding. Average tax rate total taxes paid total taxable income based on your own taxable income what would your marginal federal tax rate be.

Each bracket has a different percentage rate so that. Next add in how much federal income tax has already been. Based on your annual taxable income and filing status your tax bracket determines your federal tax rate.

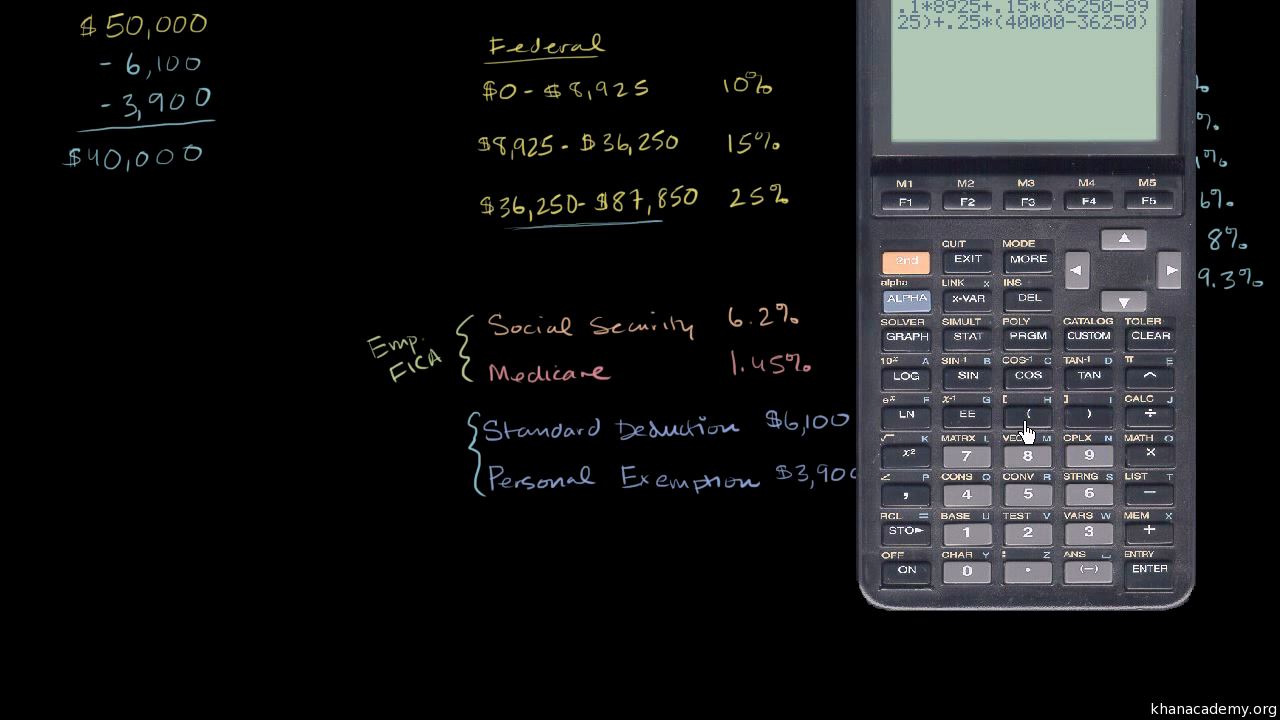

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Printable Signs Teaching Math Hourly Paycheck Calculator. 10 x 9950 995. Assume that you claim three allowances and single status on.

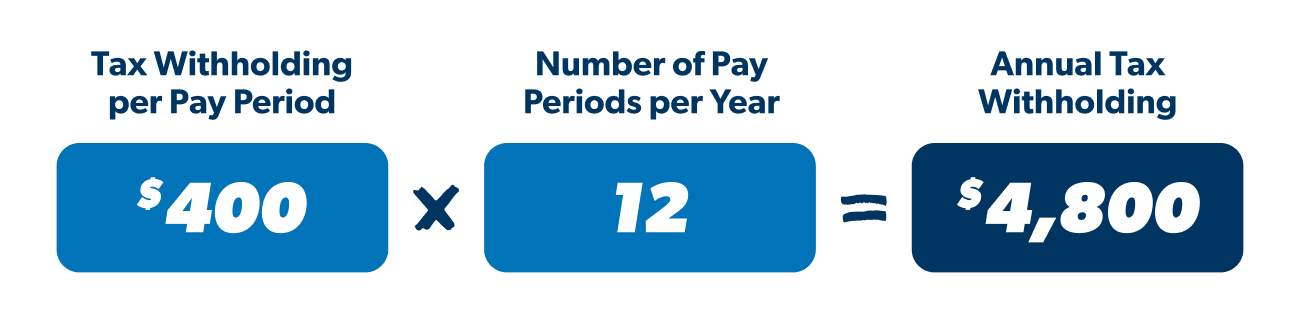

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year. Break the taxable income into tax brackets the first 10275 x 1 10.

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. The next chunk up to 41775 x 12 12. Your first 20K of income is taxed at 10 then the next 58K is taxed as 12 and so on and so on.

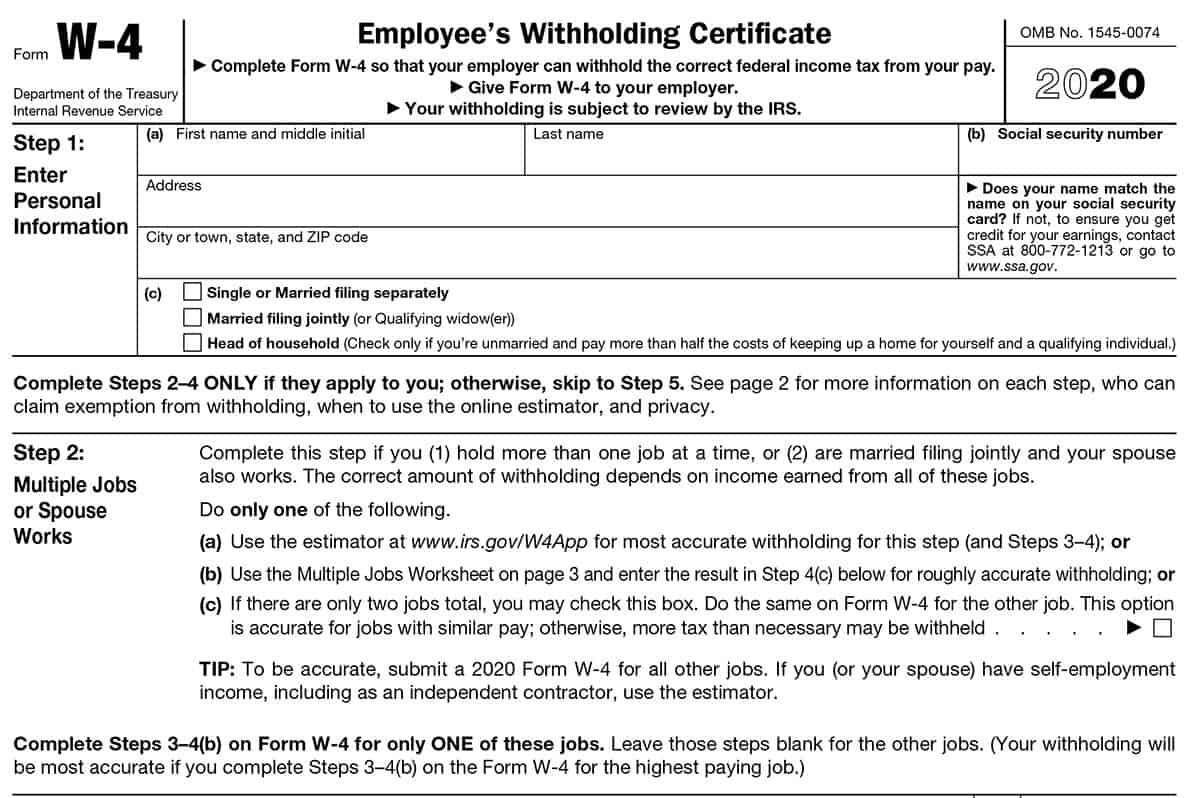

2021 Federal income tax brackets 2021 Federal income tax rates. In addition to EI and CPP you must also deduct federal and provincial income tax from employee wages. Using Worksheet 1 on page 5 we will determine how much federal income tax to withhold per pay period.

The federal government uses a. Wages paid along with any. And the remaining 15000 x 22 22 to produce taxes per.

The next 30575 is taxed at 12. A tax rate of 22 gives us 50 000 minus 40 126 9 874. Therefore 22 X 9 874 2 17228.

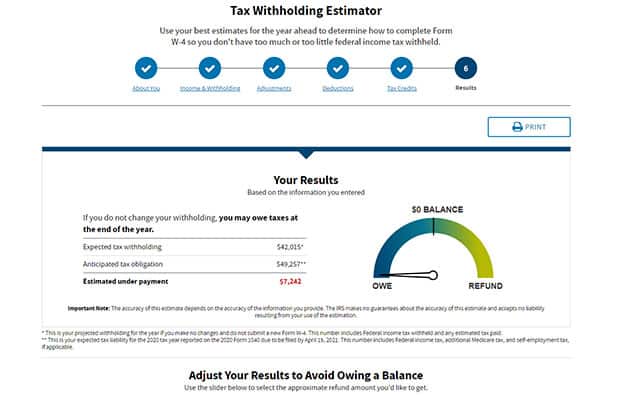

The next 30575 is taxed at 12. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. The total tax bill for your tax bracket calculated progressively is the tax rates.

If youre paid biweekly divide 70000 by 26 biweekly pay periods to arrive at biweekly salary of 269231. Average tax rate total taxes paid total taxable income based on your own taxable income what would your marginal federal tax rate be. How To Calculate Payroll Tax Province By Province.

In the case of corporate income taxation the tax bracket to be used is the 15 tax bracket. You can open the file to follow our calculations below. The first 9950 is taxed at 10 995.

Your taxable income is the amount used to determine which tax brackets you fall into. An employer generally withholds income tax from their employees paycheck and pays it to the IRS on their behalf. Wage Brackets For 2018.

Paycheck Calculator Take Home Pay Calculator

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How Do Tax Brackets Work And How Can I Find My Taxable Income

How To Calculate Federal Income Tax

How To Calculate Your Tax Withholding Ramsey

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

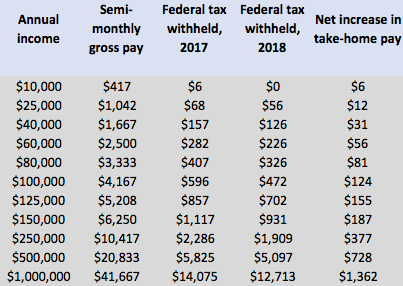

Irs Withholding Tables And A Bigger Paycheck In 2018

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

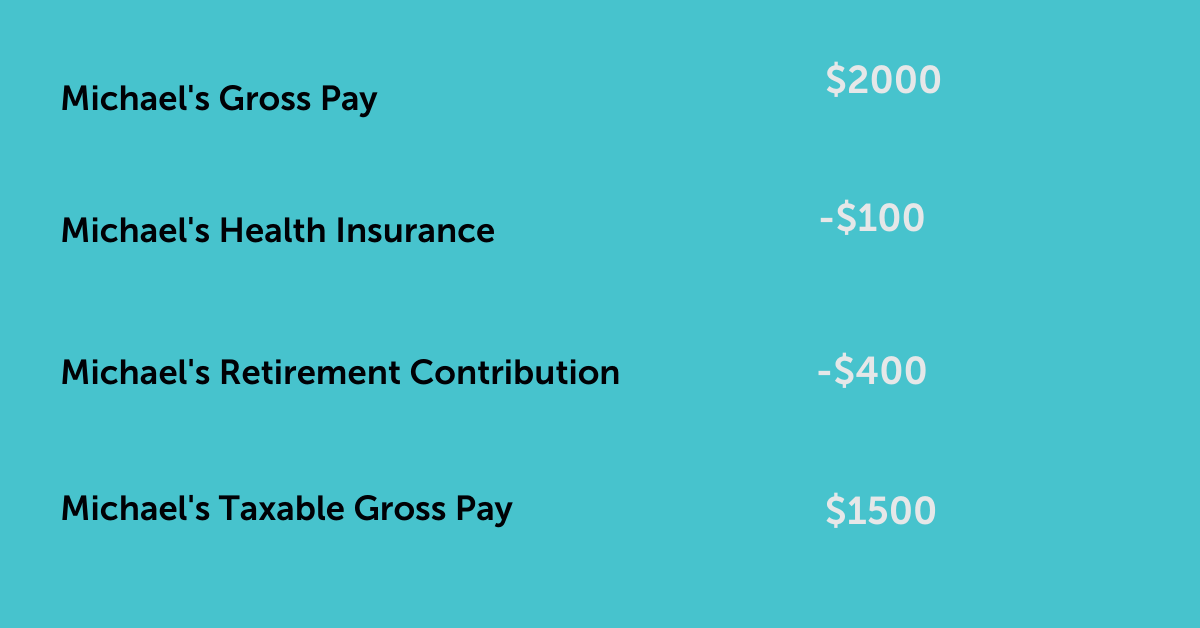

Gross Pay Vs Net Pay What S The Difference Aps Payroll

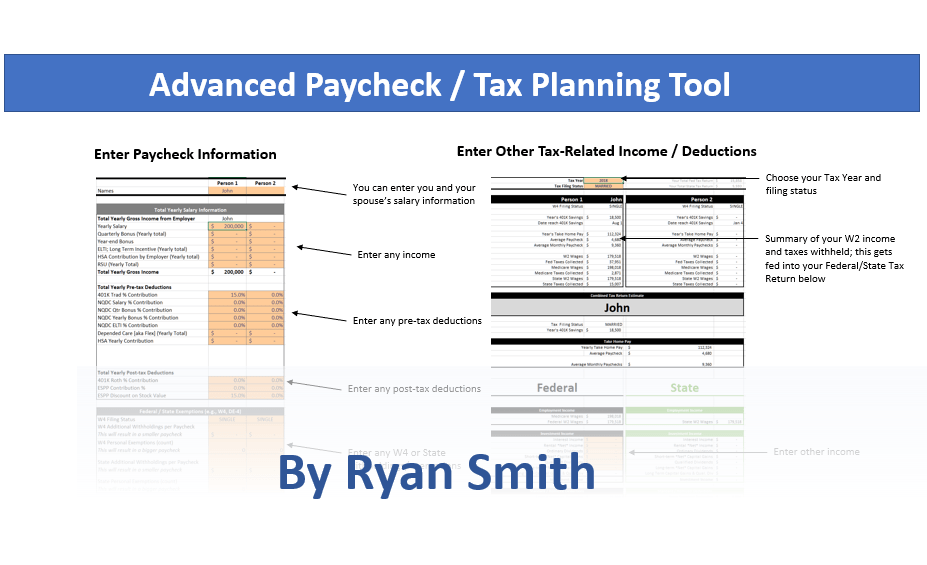

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Take Home Paycheck Calculator Hourly Salary After Taxes

![]()

How To Calculate Payroll Taxes Step By Step Instructions Onpay

Payroll Tax What It Is How To Calculate It Bench Accounting

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

How To Make Sense Of Your Pay Stub

Irs New Tax Withholding Tables

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube